中国IC设计产业的真实故事和下一波浪潮

发布时间:2010-9-26 12:01

发布者:看门狗

关键词:

IC设计

|

作者:Raymond Su 为了向中国的工程师群体分析和报道中国IC设计公司的运营状况和研发水平,《电子工程专辑》已经连续9年运作“中国IC设计公司调查”,一路伴随和见证中国IC设计产业的发展。2010年,我们继续通过电子邮件和电话追访的方式,向珠三角、长三角、环渤海以及正在中部、西部地区崛起的462家IC设计公司发出了问卷,最终获得174家公司的完整回复,有效回复量比去年增长了7%。 今年的调查数据显示,72%的IC公司的雇员少于200人,70%公司的IC设计师少于60人。而73%的公司销售额少于5千万美元,其中少于1百万美元的公司就占到21%,而销售额介于1百万至1千万以及一千万至5千万之间的公司则各占26%。大部分本土IC公司的规模依然较小,然而,注意到一些本土公司的实力和销售额正发生巨大变化。此外,中国庞大的市场和低廉的劳动力成本也正吸引越来越多的国外半导体公司来大陆设立其子公司或设计中心。

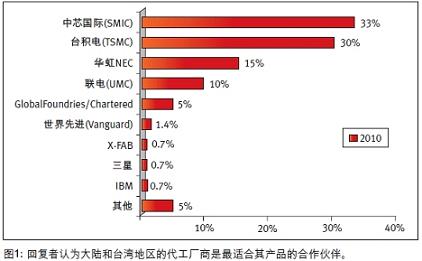

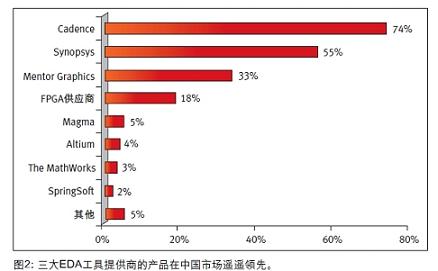

图1:回复者认为大陆和台湾地区的代工厂商是最适合其产品的合作伙伴。 表示提供全系统设计服务的公司比例依然强劲。本刊分析的原因是,迫于市场竞争的激烈,客户产品的面市压力很大,全系统设计服务前景仍然看好。而MTK的成功更是继续刺激着本土IC企业的神经,因此我们有理由相信,本土IC设计业者未来几年将不断复制“MTK模式”。特别地,越来越多的主控芯片供应商会推出多媒体平台产品。 随着本土IC设计产业的蓬勃发展,中国大陆也成为了EDA厂商和半导体代工厂竞争最激烈的阵地。 数据表明,本土无晶圆IC公司(Fabless)与大陆、台湾地区的半导体代工厂商保持稳定的合作关系。回复者认为最适合他们产品的前四大代工厂分别是中芯国际(SMIC)、台积电(TSMC)、华虹NEC以及联电(UMC)。 毫无疑问,成本和交货周期是本土IC设计公司和代工厂主要的供需矛盾,这将是长期的博弈过程。与代工厂合作过程的主要困难中,今年变化最大的是“生产能力不足”,本刊分析认为这主要来自于金融危机和经济反弹所带来的连锁反应。金融危机到来时,国外半导体供应商对市场过于悲观而反应过度,代工订单总量骤然大减。然而近期市场回暖,为了抢占市场份额,订单猛增使代工厂产能趋于饱和而无暇顾及规模较小的本土IC公司。而“没有合适的工艺”,主要来自于模拟和电源 IC对特殊工艺的需求。总言之,归结于规模小,多数本土公司在与代工厂议价和要求得到技术支持方面仍处于下风。 尽管Cadence的业务在欧美市场受到较大冲击,但在中国市场仍然是最受欢迎的EDA供应商。Mentor Graphics则凭借诸如验证、DFT等优势产品继续在中国市场快速增长。在IP业务方面,Synopsys领先于其他两大EDA巨头,其中 Mentor Graphics已经放弃在IP业务上增加投入;Cadence在IP领域上则动作频频,近期完成了Denali的收购以及与ARM在IP可互用方面展开合作,而代工厂中芯国际也表示将在IP业务上发力,值得期待。

图2:三大EDA工具提供商的产品在中国市场遥遥领先。 模拟ASIC、电源管理IC、数据转换IC和驱动器/控制器IC是回复者公司最主要从事的模拟和混合信号IC设计。而在数字IC设计方面,则集中于数字 ASIC和SoC。超过90%的公司表示进行自有品牌IC的销售。然而,产品生命周期、质量和渠道不稳定等因素使直销和分销结合的销售模式成为当前本土 IC的大势所趋。另外,在综合的设计挑战里面,降低设计成本和缩短设计周期是众多回复者公司的设计诉求。设计的具体技术挑战则表现为EMI/ESD、电源管理和IP验证等多个方面。 约6成的本土IC目标应用集中于中低端的消费电子,包括手机、PMP、STB、上网本和电子书这些现如今最热门的应用领域。目标应用为计算机及其外围、网络设备的本土IC分别有18%和10%,变化相对稳定。而飙升最快且值得关注的是汽车电子应用。我们分析的原因是:在内需政策和庞大的汽车市场推动下,汽车电子成为一些本土IC设计公司竞相角逐的市场。诚然,本土IC的应用主要还在后装车用音响以及 PND等领域。尽管合资或本土车厂对国产车用零部件的采购的扩张潜力巨大,但近期寄望本土IC在动力系统控制芯片或车用功率半导体方面打开局面的希望不大。 本土IC设计公司的能力在不断提升。尤其在全球经济后衰退期间,将是本土IC设计产业快速发展的蜜月期。单独地来看,0.13微米和0.18微米工艺的采用率依然很大,但是在90纳米以下工艺在不断增大。尽管45纳米及其以下工艺的研发成本高企,但已有少数几家本土公司的40纳米芯片已经流片,以及一些公司也处于40纳米IC的研发阶段。由于高昂的资金投入会令大多数本土公司望而却步,因此本刊相信未来几年65纳米节点将会是本土数字IC设计的主力军。从芯片的规模上来看,100万-250万ASIC门的设计项目比较突出。然而,本刊注意到一些有实力雄厚的本土公司,已经开发出几千万门规模的芯片,估计未来一两年很快有超过1亿ASIC门的芯片诞生。随着IC设计能力取得突破,本土公司实力已初露端倪,相信很快将看到越来越多的本土优秀企业在创业板甚至纳斯达克上IPO。

图3:涉及数字IC设计的回复者公司所采用的工艺技术分布。 |

网友评论